As a European, I’ve always been fascinated by how trivial and common-sense matters end up in courts. I’ve been less fascinated and more annoyed by the piles of forms and disclaimers everywhere. Finally, annoyance takes over any kind of fascination faced with the medical bills – often so high because of lawsuit-protecting insurance. As Paul H. Rubin writes in NY Times:

The United States is already the most litigious society in the world. We spend about 2.2 percent of gross domestic product, roughly $310 billion a year, or about $1,000 for each person in the country on tort litigation, much higher than any other country. This includes the costs of tort litigation and damages paid to victims. About half of this total is for transactions costs — mostly legal fees.

So why is that? One way to explore that is to examine the composition of the US Congress, as BusinessWeek has done a few years ago:

Law is the profession that’s best represented in the US Congress. How do lawyers vote compared to other professions? I’ve worked on quantitative analysis of voting behavior in US Senate a few years ago, so this is a pet interest of mine. I was thus interested to receive an email from two Swiss researchers summarizing their research:

In a study recently published in the Journal of Law and Economics (working paper version available here), Ulrich Matter and Alois Stutzer investigate the role of lawyer-legislators in shaping the law. The focus of their study lies particularly on legislators with a professional background as attorney (and not on the legislators’ education per se). In order to code the occupational backgrounds of all US Congressmen and all US state legislators over several years, the authors assembled a data set with detailed biographical information drawn from Project Vote Smart and compiled via its application programming interface (an R package that facilitates the compilation of such data is available here). The biographical information is then linked to the legislators’ voting records in the context of tort law reform at the federal and state level between 1995 and 2014.

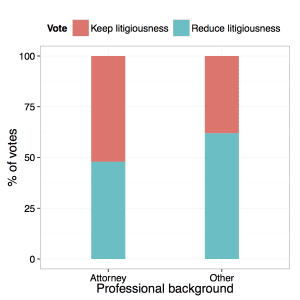

The theoretical consideration is that lawyer-legislators can, by deciding on statutory law, affect the very basis of their business and that this is particularly the case for tort law. A look at the raw data (figure below) indicates that lawyer-legislators are less likely to support reforms that restrict tort law than legislators with a different professional background.

This holds when controlling for other factors in regression analyses. For bills aiming at increasing tort liability the pattern switches and lawyer-legislators are more likely to vote in favor of bills that extend tort law than legislators with a different professional background.

Overall, the findings are consistent with the hypothesis that lawyer-legislators, at least in part, pursue their private interests when voting on tort issues. From a broader perspective, the results highlight the relevance of legislators’ identities and individual professional interests for economic policy making.

I can imagine other professions in the Congress engaging in similar protectionism of an imperfect status quo in their respective fields. It’s access to data and statistics that facilitate this necessary scrutiny in analyzing conscious and unconscious biases of legislators.

Conversely, the entire US Congress is <1% engineers and scientists combined (3+2). Peter Thiel argues that this is one of the main reasons why government sponsored innovation petered out in the US after the seventies (NASA, Bell Labs) and the country is in a science/technology stagnation.

In all fairness, doesn’t the gov’t get a lot of credit in the 80s and 90s for sponsoring innovation with things like ARPA-net (or more expansively: the entire internet), GPS devices and quite a few others that were really DARPA projects?

So in the 50’s & 60’s what was the percent of engineers and scientists in the US Congress?

It puzzles me to call the current American situation a “science/technology stagnation”. If US = stagnation, in which nation is the real dynamic science happening?

+1

Indeed, it seems that we’re in a flowering of science and technology. Maybe in particle physics they’re not moving forward like they used to, but otherwise it seems that we have lots of goodies and keep getting more.

I checked the numbers for the 50s, it was about the same: http://www.brookings.edu/~/media/Research/Files/Reports/2013/07/vital-statistics-congress-mann-ornstein/Vital-Statistics-Full-Data-Set.pdf?la=en

As for the stagnation and number of technocrats in congress, that’s Thiel’s opinion, not mine. https://www.uschamberfoundation.org/blog/post/are-we-entering-great-stagnation-thiel-and-cowen-future-innovation/42937

Personally, I immigrated to the US to pursue innovation in my small field, so what do I know?

“Overall, the findings are consistent with the hypothesis that lawyer-legislators, at least in part, pursue their private interests when voting on tort issues.”

I’m not so sure. I don’t have any data on this, but it is my impression that congressional legislators usually do not do litigation practice once they are elected. While holding office, they usually have no other job. And they are more likely, after leaving office, to either retire or work for lobbyists, other trade/industry organizations, or, if they return to legal practice, to do non-litigation work. So it may not be so much a matter of pursuing private interests here as just being attuned by their backgrounds to favorable views of litigation.

I’m also not so sure it’s to “pursue their private interests” (assuming that “interests” means financial.) I would guess that it may simply be a matter of genuinely believing that tort litigation is important in the process of bringing justice when there are unfair processes. In other words, believing what they have been trained to believe.

+1

I once asked a retired lawyer friend if he could suggest a couple of resources for a young friend who might have had a complaint about his employer.

I was looking for perhaps a referral to a legal aid clinic or advice on how to take advantage of a (free) 1/2 law consult so my friend could ask a couple of questions.

Said retired lawyer was gearing up to have my friend in court before I explained the entire situation. I think it is instinctive.

GOOD

I’m not sure I trust the bookkeeping in that BusinessWeek graphic. It says that there were 8 fewer Republicans in the House and 2 fewer in the Senate for a total loss of 9 (8+2=9 ??).

Happy to replace this with a different source? Any suggestions?

Is it necessarily conscious or unconscious bias? It can simply be that lawyers vote differently on these issues than non-lawyers because they are better informed, potentially less biased in fact.

This consideration is mostly just playing devil’s advocate — However, I’m very skeptical to hear any such conclusion being jumped to. For instance, it sounds suspiciously like the rationale used to discredit all climate researchers’ opinions on climate change, on the basis that their positions are self-serving.

More broadly people seem too eager to see every motivation as cynically self-serving.

Do you have any good pointers to tort being a good thing given the 50% legal cost overhead?

I’m not a lawyer at all, but pretty much every instance of tort I’ve encountered has some clear positive motivation behind it. Product safety, malpractice, breach of contract, etc. — basically providing restitution and punishment whenever criminal law isn’t appropriate.

Regarding the overhead, part of the rationale for tort is punitive, to an extent court costs being paid by the losers just increases punishment for wrongdoing. To take it to the extreme, with 50% overhead costs, it might just be cheaper in the immediate term to abolish all tort law and pay claimants — but rather than paying to punish civil breaches as we do today, we’d be instead paying simply to encourage spurious untried claims, while doing nothing to punish true offenders.

Reading other comments I realize I was wrong to conflate tort law with all civil suits. Still feel the same way about the gist of the argument, that punishment and punitive costs can justify overhead costs exceeding compensation extracted.

@Aleks

Tort reform is one thing, but surely you aren’t saying torts are evil by definition? Are you advocating getting rid of tort law entirely?

I’m definitely not qualified to decide or even comment on matters like this. I can, however, compare different countries I’ve lived in on an anecdotal basis, and discuss how to increase transparency of the legislative process through data analysis.

OK. I was confused by your question asking “Do you have any good pointers to tort being a good thing given the 50% legal cost overhead?”

It sounded like you were convinced that torts were evil.

I think this could be teased out by looking at the types of attorneys they are and whether they or their previous firms would directly benefit from the legislation.

If the difference disappears for attorneys that do not directly benefit, then one has an argument for bias.

Maybe yes, maybe no. Particularly, such a result would be ambiguous under the original argument I made.

Even if you show a difference between lawyers/firms working directly on a particular type of tort law and those that do not, you’re again not only drawing a distinction in terms of self-interest and benefit, but also of knowledge and expertise.

Not true. The expertise is there, simply at a lower level. So if it disappears entirely, that is an argument for bias. If it does not, then that is an argument for expertise.

“It can simply be that lawyers vote differently on these issues than non-lawyers because they are better informed, potentially less biased in fact.”

You raise an important point. Better knowledge might play a role. However, on its own it might not be sufficient as a concurrent hypothesis on how lawyer-legislators vote on tort issues. There must be an additional reason to vote in favor or against tort reforms. Say, all legislators want ‘what is best for society’ (if we assume this could actually be assessed),but some are better informed about ‘what’s best’ depending on the issue and their professional background. In that case, lawyer-legislators probably would know better ‘what’s best for society’ and might therefore vote differently than other legislators who are less well informed.

If that were the case, we might expect other legislators with legal training but no occupational background as attorneys (such as former judges, law professors, etc.) to also know better ‘what’s best for society’ and vote on tort issues in line with lawyer-legislators. At least in the data we have, this does not seem to be the case.

Another interesting aspect of the ‘information-hypothesis’ is that many studies in the field of Law and Economics attempt to assess what form/extent of tort law would be favorable from a welfare perspective. However, there does not seem to be a clear consensus on whether tort reforms are needed or not from this point of view. In fact, some of the top legal scholars in the USA seem to disagree on key issues here. See, for example, the discussion about product liability in the Harvard Law Review between Polinsky and Shavell (https://dash.harvard.edu/bitstream/handle/1/10900865/polinsky_shavell.pdf?sequence=1, http://harvardlawreview.org/2010/06/a-skeptical-attitude-about-product-liability-is-justified-a-reply-to-professors-goldberg-and-zipursky/) and Goldberg and Zimpursky (http://www.harvardlawreview.org/wp-content/uploads/pdfs/vol123_goldberg_zipursky.pdf).

That said, it might, of course, still be the case that one only learns ‘what’s best’ in the context of tort reforms by actually practicing law (i.e., lawyer-legislators would know better than legal scholars due to their experience in practicing law).

Given that most tort law is governed at the state level, the number of lawyers in state legislatures is the relevant database, not the number of lawyers in Congress.

And, by the way, what is the source of the claim that medical bills are high because of the cost of malpractice insurance? This study claims that they are 2.4% of costs: http://www.hsph.harvard.edu/news/press-releases/medical-liability-costs-us/

Finally, it is misleading to say, “This includes the costs of tort litigation and damages paid to victims. About half of this total is for transactions costs — mostly legal fees.” Plaintiffs’ legal fees are paid out of damages, so that part of legal fees is not an additional transaction cost.

Oh good, somebody said this already—when talking about the high cost of health insurance I am also skeptical of blaming legal costs. I’m pretty sure that at least 1) young people bailing on health insurance; 2) the limited negotiating power of health insurance companies; and 3) widespread obesity are more important than legal costs—although I also don’t have citations on hand.

Also, it took me a long time to understand that the cost of malpractice insurance is largely riven by the stock market (since the premiums are invested and the payoff of that is what is used to pay claims). So when the markets go bust or interest rates fall premiums have to go up to cover the same costs.

This is a bit too simplistic… to the point where I’d say it’s just not an accurate statement.

First, the ability to earn income on float (insurance premiums not yet paid out) affects pricing in all private insurance markets — so you’d need to step out of sample and decide whether the US insurance premiums in auto, life, homeowners, etc. are all high vs say western Europe. If not (possibly after making duration adjustments), then I’d discard this reason in context of malpractice insurance.

Second, it’s worth pointing out that in principle stock markets crashing and interest rates falling are kind of opposite things. In the former, at a high level, expected returns go up as prices go down. In the latter expected returns (i.e. interest rates) go down as bond prices go up. (This is oversimplistic and ignores some important things like inflation as well as credit risk differences but keep in mind there is only so much I can reasonably put in a blog reply.) In principle the former does not make any sense for causing premium price increases—it is equivalent to shutting the barn doors after all the animals have run out; but such a phenomenon can occur. (Berkshire Hathaway points this out all the time and does poke at the odd lemming behavior of competitors.)

That said, your interest here should be in fixed income markets (i.e. interest rates), not equities. In terms of regulations — other than Berkshire (who gets some slack) — insurance companies are forced to allocate overwhelmingly to fixed income and away from equities so as to be largely immune to stockmarket pricing.

The final point here is to actually do some calculations to ball park the cost (or put a lower and/ or upper bound on cost impact if that is your thing).

Really low interest rates do hurt income that can be earned on float (i.e. premiums that have been collected but not yet paid out), so all else being the same a decrease in interest rates can put upward pressure on premiums. My understanding of malpractice insurance is that the standard policy is one year long (for purposes of a blog post reply, this does not analyze long tail policies specific to terminating a relationship with an insurance carrier). If you actually look at 1 year treasury rates over the past, say 25 years (http://www.multpl.com/1-year-treasury-rate/) and do the math involved the drop in one year rates from ~8% to ~0.5% would have in itself lead to a raw ~7.5% increase in policies over those 25 years – i.e. 0.3% compound annual price increase. When people talk about high prices and unacceptable exponential growth in health care costs (specific to mal practice and more general), it is not 0.3% pa cost increases that they are talking about.

Well that was my real point, the idea that health costs are largely driven by changes in malpractice rates is not borne out. And yes it is simplistic, because insurance companies invest in all kinds of things (Met Life built huge housing developments in New York). https://www.chicagofed.org/~/media/publications/chicago-fed-letter/2013/cflapril2013-309-pdf.pdf. There are a lot of factors that explain why the cost of premiums to medical providers goes up and down year to year (just like for other insurance products) and periodically they spike up. The so-called “insurance cycle” means there are times of “crisis” where payouts run ahead of reserves and prices go way up, and then things go back down again when profits increase and competition grows. Return on investments matter, but they are certainly not the only factor. People sometimes forget that the insurance industry has a lot of people making business decisions based on competition, legal environment, costs, market, and predictions of the future, with companies making adjustments all the time (http://www.aria.org/meetings/2012%20Meetings/3B-Underwriting%20Strategy.pdf has a lot of graphs about companies entering, exiting and changing their strategies in the malpractice market).

I was chatting with a trial lawyer earlier today, but he’s gone so I’m not able to discuss this point. My rough recollection is that there are a ton of safe harbor provisions done in at the federal level in re: torts in healthcare.

I think mostly malpractice insurance (or suing doctors) is referred to for its suspected indirect costs.

There’s this really awful joint hypothesis problem in healthcare, where patients are given expensive procedures, tests, medicines, and so forth that a lot of thoughtful doctors (particularly in Europe, but also in the US) say aren’t needed.

The joint hypothesis problem comes in a few variants but the core one is: doctors say they are doing all these over the top tests, over-prescribing meds, etc. so that they can’t be sued for missing things however rare. They call it defensive medicine. Critics of medical practices point out that in a fee per service model doctors / their employers (at a high level) in effect get paid a % of the revenues they generate which means they have terrible incentives to overprescribe irrespective of the legal environment. The most thoughtful people try (quite imperfectly but its a worthwhile effort) to step out of sample and look at the practices in integrated care models (e.g. Kaiser Permanente) vs fee-for-service.

I haven’t looked at this closely in a while, but my recollection is that fee-for-service has some troubling attributes (though capitation in the 90s was hardly clean — that’s outside the scope though), but so does the legal framework. From what I’ve seen, both doctors and trial lawyers generally don’t like to acknowledge this point.

Food for thought.

Your point about doctors benefiting is too often overlooked I think.

When you consider the staff in hospitals, the owners, the private practices, the spin off drug companies, the labs, the colleges, teaching hospitals, residency requirements, all of the decision makers and stakeholders are medical doctors, pretty freely overlapping between parts of the business model.

All the worst inefficiencies in US health care benefit some decision makers along the business model. The counterbalancing hardships, the shortages, the educational costs, the hardships of residency, all too are the direct results of senior doctors making decisions. Whether these decisions only incidentally or selfishly serve to insulate their high profit business models from criticism, is not the most important point. Doctors, their business and associations have the greatest responsibility for the cost and standards of care.

Tort and malpractice along with insurance profit only amount for a small portion of health care costs. Tests, drugs, standards of care, poor administration, poor technology, the rest of the actual costs, can be laid at the feet primarily of senior doctors.

All countries have senior doctors but health care is far more expensive, and no better (judgedby outcomes) , in the US. This strongly suggests the problem lies in the system (for profit etc) than in the senior doctors.

I’m sorry to be critical, but this commentary is the sort of just-so-story that this blog usually rails against. The article (which I only glanced at) seems to be clear in that it’s only looking at Congress, and laws on tort reform — not making general statements about underpinnings of a “litigious” society. For the latter, it would be important to keep in mind that:

(i) the vast majority of laws, statutes, and court cases in the U.S. are at the *state*, rather than federal, level [1]. So if one did want to look at laws that “keep” or “reduce” litigiousness in general, state law and lawmakers are far more relevant.

(ii) What fraction of overall lawsuits are tort lawsuits? I don’t know, but I would guess that it’s small. Perhaps the author means to use tort reform laws as a proxy for a broader set of laws about lawsuits? If so, it’s not clear how such a link would be made. Incidentally, for a different perspective on torts, see e.g. [2].

(iii) As always, the important question is not “is there an effect?” but “what is the effect size?” In the study, the correlation between party (R or D) and tort-law-vote is *far* greater than the background of being a lawyer. So, even if one wanted to use this study to “explain” litigiousness, the place to start would be differences in philosophical backgrounds that determine party affiliation, I would think. (Disclaimer: I’m no political scientist.)

I could go on, but my overall point is that this commentary seems to take the easy path of “Lawyers! Boo! Hiss!” and over-extrapolation to make grand claims about society. I appreciate the approach of looking at data, and the author’s pointing us to an interesting dataset and analysis.

[1] https://en.wikipedia.org/wiki/Law_of_the_United_States#State_law

[2] http://www.economist.com/news/united-states/21672302-flaming-rats-and-exploding-cars-are-stars-new-museum-ralphs-house

“The article (which I only glanced at) seems to be clear in that it’s only looking at Congress”

Just to clarify, the study is based on votes on tort law reforms at the federal as well as the state level. Actually, the majority of votes (and bills) considered in the analysis are at the state level. From the article:

“…data set with the records from 64 votes on 48 different bills concerning tort law issues in 17 state legislatures and Congress between 1995 and 2014. All 14 votes at the federal level concern bills that restrict liability. In that sense, they are typical tort reform bills, aimed at reducing the amount of damage payments and/or the number of tort cases, for example, by introducing caps on noneconomic damages. At the state level, 12 of the 50 votes concern bills that extend the existing tort liability, for instance by removing caps on noneconomic damages.”

In that sense, I agree with your point (i), it is potentially important to consider state law and lawmakers in the context of tort reforms.

“Law is the profession that’s best represented in the US Congress” – this implies (?) that law is overrepresented in US government compared to other professions. But to answer the question in the post title, we need to know whether lawyers are overrepresented in US government relative to other _countries_. Are they?

You are quite right to ask this. As usual, The Economist nicely fills in some of these details.

(excerpt from: http://www.economist.com/news/united-states/21588120-dangers-taking-legalistic-approach-americas-budget-wars-lawyers-beware-lawyers )

” Though fewer than one in 200 Americans has a law licence, the profession can lay claim to a third of the current House of Representatives and to more than half the seats in the Senate.

For comparison, in both Britain’s House of Commons and its Canadian counterpart just one in seven members is a lawyer, and one in 15 deputies in the French Assemblée Nationale. A Lexington’s Law suggests itself: just as Britain should limit its cabinet to two old-Etonians, Congress should try to rub along with no more than two dozen Harvard or Yale Law graduates at a time.

The imbalance is not new: more than half the men who signed the Declaration of Independence had a legal training.

”

The piece is from 2013… it would have been nice to know the base rate of law licenses in Britain and France for the gen. population, but I don’t think it’s in there.

So the difference between lawyers and non-lawyers seems only about 12 percentage points.

Isn’t this sort of difference very sensitive to what one classifies as “keep litigiousness” versus “reduce litigiousness”? Are these rubrics always crystal clear on votes or is there leeway for a researcher degree of freedom here?

You raise an important point that is relevant to every empirical study investigating legislative voting behavior in the context of bills of a specific domain. One way to deal with this issue is to document the sample selection as transparent as possible as well as to facilitate the access to the raw data (the universe of votes under potential consideration) for the research community. That way, other researchers can retrace why what has been selected as well as what has not been selected (and for what reason). This is, however, rarely done in the literature.

In the case of tort law, the coding of reform bills (as either restricting or extending liability) is greatly facilitated by two factors. First, statutory tort reforms in the USA are very well documented in the Law and Economics literature. Legal scholars and economists have described what type of reforms were enacted, what their intention was, as well as what incentives they set in the tort system. Second, as many reforms are motivated/pushed forward by the American Tort Reform Association (ATRA) their intention to reduce tort liability is often even in the original bill text (or the title) explicitly made clear (i.e., the bill text literally mentions that the aim of the bill is to reduce tort liability).

Thanks for the clarification.

Another question: What is the lawyer vs non-lawyer vote difference on various random, unrelated bills (or a bill class) where one wouldn’t perceive any self-interest.

i.e. I’m trying to juxtapose a 12 percent point vote difference against just vote-to-vote background noise.

If I get your point correctly, you hint to the possibility that attorneys might generally (or often) vote differently from other legislators on various issues (including tort law). If this were the case, it would not be surprising to find differences in the case of tort reforms, and it might be less clear whether the statistical regularity is in line with our politico-economic hypothesis.

In our study we thus also investigate whether ‘lawyer-legislators are simply different’. From the online appendix of our paper: “First, we analyze whether lawyer-legislators vote systematically differently in votes on various other bills by a similar magnitude as observed for tort reforms. Second, we test whether the difference in voting behavior can be statistically accounted for by lawyer-legislators’ complete roll call records.”

The results indicate that (i) it is very unlikely to get similar effects (differences in voting behavior between lawyer-legislators and other legislators) with samples on various random, unrelated bills. The estimated effects do not even come remotely close to the ones in our main study (both in terms of magnitude and in terms of statistical sifnificance). And (ii), the difference in voting behavior cannot be statistically accounted for by lawyer-legislators’ complete roll call records (captured in their DW-Nominate scores). One way to interpret this result is that lawyer-legislators’ general voting behavior (relative to the voting behavior of other legislators) cannot account for their voting behavior in the context of tort reforms.

Details of these results are presented in the online appendix to the paper: https://wwz.unibas.ch/fileadmin/wwz/redaktion/wipo/Alois_Stutzer/Matter_Stutzer_LLVotingBehavior_OnlineAppendix.pdf

Hmm, actually according to the Brookings Institute the number of engineers in the House of Representative has stayed at the same level of the 1950s (about 7 per year) while the number of lawyers dropped significantly from the 240-250 range to 152 and 156 in the last two. The numbers didn’t change much for senators (~2 engineers, ~60 lawyers).

http://www.brookings.edu/~/media/Research/Files/Reports/2013/07/vital-statistics-congress-mann-ornstein/Vital-Statistics-Full-Data-Set.pdf?la=en

Where did BusinessWeek get their data?

I suspect that the reason why there are far more lawyers in Congress than engineers (despite there being twice as many engineers as lawyers in the general population) is because while engineers solve problems, lawyers create them (in part for the reasons Matter and Stutzer propose: creating problems makes them money)

The difference might be due to Brookings reporting the occupation of legislators (more exactly it looks like the industry in which they worked before serving in Congress) and the paper using educational background. For example, there are quite a few members of Congress who worked in banking – their occupations are reported as “Banking” in the paper but they may be lawyers by education in the Brookings data. I’m not sure if this fully accounts for the difference, but it might.