A few weeks ago I wrote about the importance of demographics in political trends. Today I’d like to show you how demographics help predict financial crises.

Here are a few examples of countries with major crises.

-

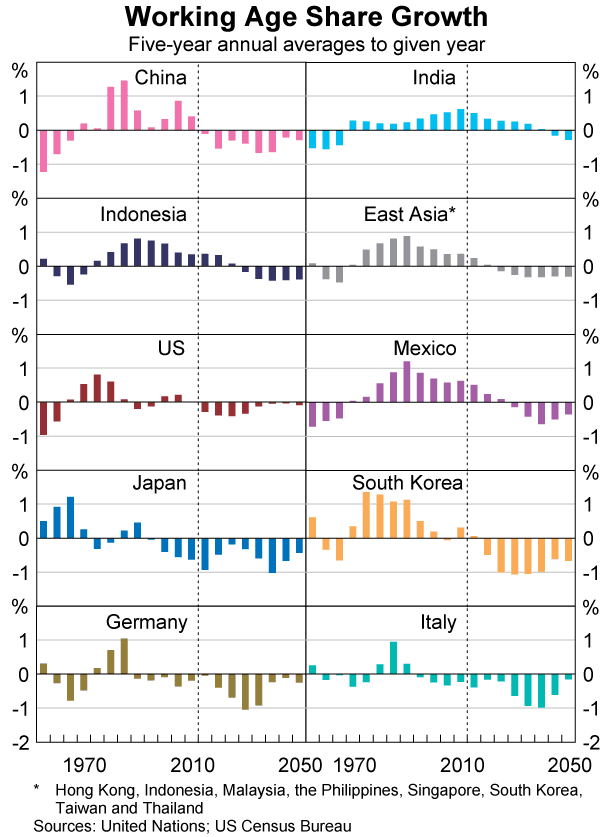

- The working-age population in Japan peaked in the 1995 census.

- The 1995 Financial Crisis in Japan

-

- The working-age USA population growth slows down to unprecedented levels in 2008 (see figure below)

- Financial crisis of 2007-2010. (Also, notice previous dips in 2001, 1991 and 1981, and consider the list of recessions.)

- China’s working-age population, age 15 to 64, has grown continuously. The labor pool will peak in 2015 and then decline.

\t

\t

There are more charts in Demography and Growth report by the Reserve Bank of Australia:

Wikipedia surveys the causes of the financial crisis, such as “liquidity shortfall in the United States banking system caused by the overvaluation of assets”. Oh my! Slightly better than the usual Democrat-Republican finger pointing, but no, no, no, no. One has to pick the right variables to explain these things. Why were the assets overvalued?

There is a simple answer: not enough people have been looking at demographic trends to understand that it’s the working-age population that buys most of the goods, services and real estate.

Back in 2007 I found a book by Henry S. Dent, the main message of which was nicely summarized by this March 2000 article in Businessweek:

The bull market is as vast and powerful as the baby boomer generation, and the two are inextricable. The 80 million or so boomers–those born between 1946 and 1964–are hitting their peak earning, spending, and investing years, and that’s what’s driving the economy’s incredible performance and the stock market’s spectacular returns. His target for the Dow is 40,000–which he believes it will hit somewhere around 2008.

After that, watch out. As an economic force, the boomers will have peaked, and there just aren’t enough Generation Xers to sustain the economic and stock market boom. Even the revolutionary changes wrought by the rapid growth of the Internet don’t change that. In Dent’s view, the economy goes into a deflationary funk for another 10 or so years, until the boomers’ children–the 83 million ”echo baby boom” generation–reach their economic prime.

Unfortunately for Dent, there was the 2001 dip before the 2008 drop.

Assuming economists finally learn the demographics they should have known for a long time, the next financial crisis will be caused by some other under-appreciated variable.